File Your Taxes Online: Expert Tax Accounting Services in Canada

As the tax season approaches, many Canadians are considering how best to file their taxes online, with options for online free services available. Utilizing tax accounting services can streamline the process and ensure that you maximize your tax refund while staying compliant with Canadian tax laws. This guide will explore the best tools and resources available for filing your taxes online, how to get expert help with your individual tax return, the process for filing with the Canada Revenue Agency (CRA), tips to enhance your tax refund, and the differences between individual and corporate tax services.

What Are the Best Tools and Resources to File Your Taxes Online?

How to Choose the Right Tax Software for Your Situation?

Choosing the right tax software is crucial to effectively file your taxes online. Different tax software options such as TurboTax® Canada and Simple Tax cater to various tax situations and are considered registered trademarks in the industry. When selecting tax software, software companies must consider your individual tax needs, such as whether you have multiple income streams, investments, or deductions. Additionally, you should review the user interface, available features, and whether the software is certified by a reputable authority. Certified tax software often ensures compliance with current tax laws and provides a more reliable user experience, which is crucial for avoiding any block error on your return. For instance, TurboTax free options are available for straightforward tax situations, allowing you to file your return easily and efficiently through their software products.

What Are the Benefits of Using Certified Tax Software?

Using certified tax software provides numerous benefits that can significantly enhance your tax preparation experience, especially for your 2025 tax return, making it the best way to file and maximize savings will vary based on your situation. Firstly, certified software is designed to comply with the latest tax regulations set forth by the Canada Revenue Agency (CRA). This compliance minimizes the risk of errors that may arise when using non-certified tools, which can affect your average refund amount. Furthermore, certified tax software products often include built-in checks and balances that help identify potential tax credits and deductions you might qualify for, thus maximizing your tax refund. Additionally, many certified options, such as those from Intuit, offer features like direct deposit for swift refunds, ensuring you receive your refund amount promptly and without any additional charge.

How to Access Resources from the Canada Revenue Agency (CRA)?

The CRA offers a plethora of online resources that can assist you in filing your taxes. Accessing these resources is straightforward; you can visit the official CRA website at Canada.ca for page details on tax filing, which may be subject to change without notice, as the CRA reserves the right to modify information. Here, you can find guidelines on various tax topics, including information on tax credits, deductions, and necessary forms for the 2025 tax year. The CRA also offers an online portal for taxpayers to view their tax situation, check the status of their tax return, and receive a reply regarding any queries in both English and French. Utilizing these resources can help you understand your obligations and rights as a taxpayer, making your tax filing process smoother.

How Can I Get Expert Help with My Individual Tax Return?

When Should I Consult a Tax Expert for My Tax Situation?

Consulting a tax expert can be invaluable, especially if your tax situation is complex and requires specific work details. If you have multiple sources of income, significant investments, or are unsure about the available tax credits, it’s wise to seek professional tax services at your sole discretion to make tax filing easier. Additionally, if you have undergone life changes such as marriage, divorce, or the birth of a child, these factors can significantly impact your tax return. A tax expert can provide personalized tax advice tailored to your circumstances, ensuring that you file your return accurately and maximize your refund while helping you stay up to date on tax changes.

What Services Do Tax Professionals Offer for Income Tax Returns?

Tax professionals provide a range of services that can enhance your tax filing experience. From tax preparation to strategic tax planning, they can help you navigate the complexities of the tax system and ensure all tax returns filed are accurate, particularly over the past 5 years. Tax accountants not only prepare your personal income tax return but also offer advice on how to structure your finances to minimize your tax liability, ensuring compliance with all terms and conditions. They can identify potential deductions that you may not be aware of and help you understand the implications of certain financial decisions on your taxes. Furthermore, tax preparers can represent you in case of an audit by the CRA, providing you with peace of mind during the tax season.

How to Prepare for a Meeting with a Tax Accountant?

Preparing for a meeting with a tax accountant is essential to ensure a productive session regarding your tax and benefits. Before your meeting, gather all relevant documents, including your previous tax returns, T4 slips, receipts for deductions, and any other financial statements. This information will help your accountant understand your tax situation better. Additionally, prepare a list of questions or concerns you may have regarding your tax return or tax credits. By being organized and proactive, you can maximize the benefits you receive from your tax accounting services.

What Is the Process to File Your Taxes with CRA?

What Documents Do I Need to File My Tax Return?

To file your tax return with the CRA, you will need several documents to ensure accuracy and compliance, particularly for electronic filing. Essential documents include your T4 slips, which report your employment income, and any T5 slips for investment income. If you are eligible for specific tax credits, gather receipts or documents that support your claims. Additionally, if you have made contributions to RRSPs or other tax-deferred accounts, include documentation for those as well. Having all necessary documents on hand will facilitate a smooth tax filing process and help you avoid delays, particularly when you choose to auto-fill my return.

How to Use Netfile to Submit Your Taxes Online?

Netfile is a convenient service provided by the CRA that allows you to file your taxes online securely. To utilize this service, you must first prepare your tax return using certified tax software that includes personal information securely. Once your return is complete, you can simply log into the Netfile portal via the CRA website and submit your return electronically. The process is straightforward and typically results in faster processing times compared to paper filing, making it the best tax option for many who prefer to file with us. After submission, you will receive confirmation of your filing, and if you opted for direct deposit, you can expect to receive your refund amount directly into your account, based on individual preferences.

What to Expect After Filing Your Tax Return with CRA?

After filing your tax return with the CRA, you can expect a few things. First, the CRA will process your return, which typically takes a few weeks during the busy tax season, but they reserve the right to modify processing times for any reason. You can track the status of your return through your CRA account on Canada.ca and file with us for easier management. If there are issues or if the CRA requires additional information, you will receive communication regarding your tax situation. If your return is accepted without issues, you can look forward to receiving your tax refund, if applicable, through direct deposit or a cheque in the mail, which can be processed as a return at no additional charge.

How Can I Maximize My Tax Refund This Tax Season?

What Tax Credits Are Available for Individuals in Canada?

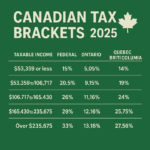

To maximize your tax refund, it’s essential to understand the variety of tax credits available to individuals in Canada, as well as the terms and conditions that apply to tax returns filed by 2025, including potential audits and reviews. Common credits include the Canada Workers Benefit, the GST/HST credit, and various provincial tax credits that can significantly reduce your tax liability, especially when included in your personal tax planning. Understanding which credits you qualify for can substantially increase your prior tax refund. Each tax year, the CRA updates the list of available credits, so be sure to check the latest information on their website to ensure you are taking full advantage of what is offered for your tax return for the year.

How to Identify Deductions That Could Increase My Refund?

Identifying deductions is a crucial step in maximizing your tax refund. Common deductions include those for medical expenses, charitable donations, and certain employment-related expenses. It’s advisable to keep meticulous records of all relevant expenses throughout the year, as this will make it easier to identify potential deductions when preparing your tax return. Engaging a tax expert can also aid in uncovering additional deductions you may not have considered, further enhancing your refund potential.

What Are Common Mistakes to Avoid for a Higher Refund?

Avoiding common mistakes during tax filing is vital to achieving a higher refund. One prevalent mistake is failing to report all income sources, which can lead to penalties and a smaller tax refund. Additionally, neglecting to claim eligible tax credits and deductions due to lack of awareness is another frequent error in personal tax returns, which can impact the average refund amount. Lastly, ensure that all personal information is accurately included in your return, as discrepancies can delay processing and affect your refund amount, potentially resulting in an additional charge. By staying informed and vigilant, you can navigate the tax season with confidence and directly to the CRA to secure the refund you deserve for every tax return, as they reserve the right to modify policies at any time.

What Are the Key Differences Between Individual and Corporate Tax Services?

How Do Corporate Tax Returns Differ from Individual Tax Returns?

Corporate tax returns differ significantly from individual tax returns in several ways. Corporations are subject to different tax rates and regulations compared to individuals, and their tax obligations are required to pay based on their income levels. Moreover, corporate tax returns require additional documentation, including balance sheets, profit and loss statements, and shareholder information for proper filing services, which are subject to change without notice. The complexity of corporate tax filing necessitates a deeper understanding of tax laws, making it essential for businesses to engage qualified tax professionals who specialize in corporate tax services.

What Are the Benefits of Professional Tax Services for Corporations?

Engaging professional tax services for corporations offers numerous advantages. Tax experts can help navigate the intricacies of corporate taxation, ensuring compliance while maximizing deductions and credits that may apply to the business. This expertise can lead to significant tax savings, enhancing the overall financial health of the corporation. Furthermore, professional tax services can provide strategic tax planning, helping businesses position themselves favorably for future growth and stability.

How to Navigate Your Corporate Tax Situation with CRA?

Navigating your corporate tax situation with the CRA requires a comprehensive understanding of both tax obligations and available strategies. Corporations must file their tax returns within specific deadlines and maintain accurate records to avoid penalties, especially in light of changes without notice. Working with a tax accountant can ensure that your business is compliant with all CRA regulations while taking advantage of potential tax credits and deductions. Regular consultations with tax professionals can help corporations stay updated on changes in tax laws and optimize their tax strategies effectively.